Description

Price: $9.95 - $9.45

(as of Mar 30, 2025 07:14:32 UTC – Details)

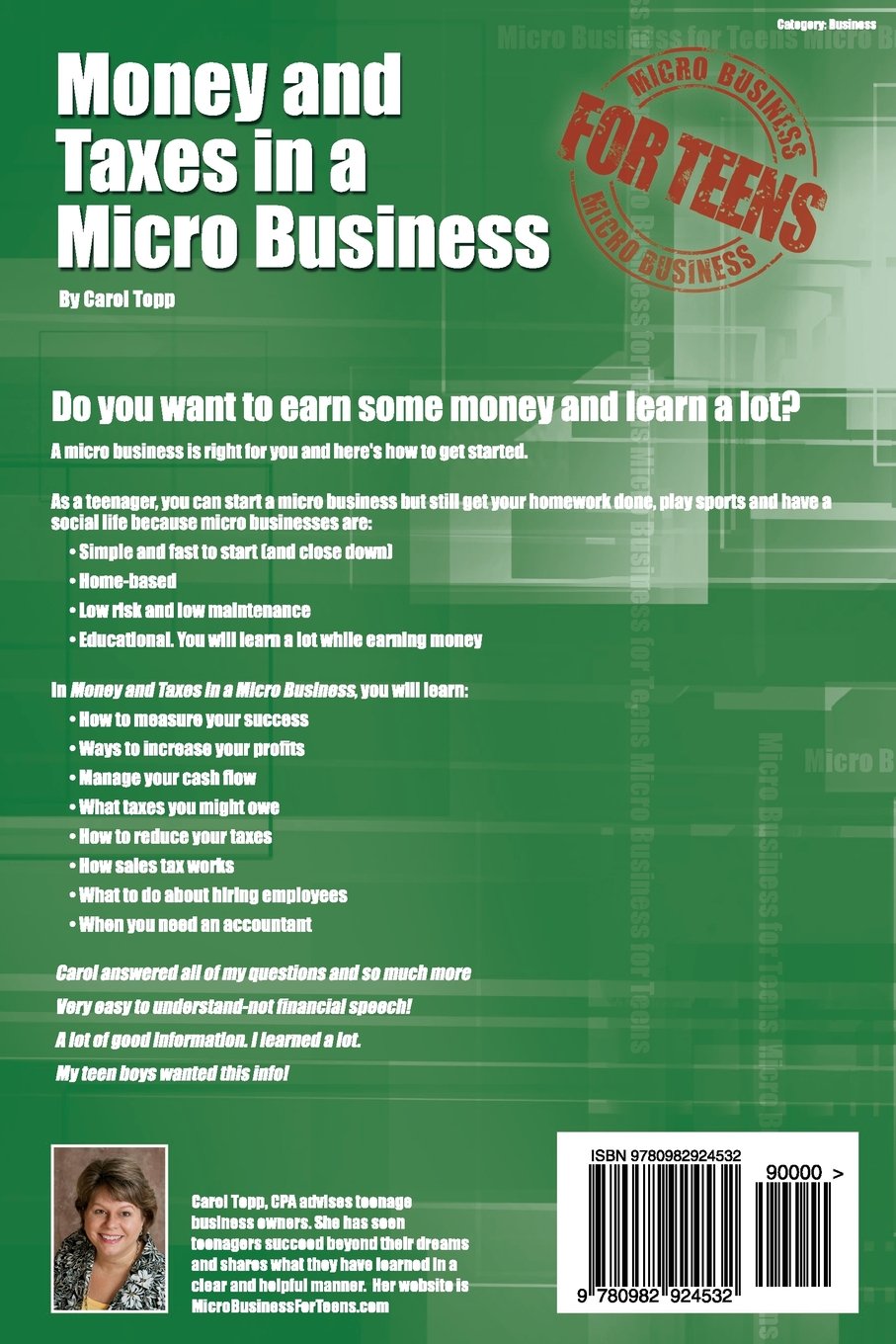

Money and Taxes in a Micro Business is part of the Micro Business for Teens series. In it you will learn -How to measure your success-Ways to increase your profits-Manage your cash flow-What taxes you might owe-How to reduce your taxes-How sales tax works-What to do about hiring employees-How to work with an accountant

Publisher : Ambassador Publishing (January 25, 2011)

Language : English

Paperback : 128 pages

ISBN-10 : 0982924534

ISBN-13 : 978-0982924532

Item Weight : 6.4 ounces

Dimensions : 6 x 0.29 x 9 inches

KJ –

Another Loved Carol Topp Book!

I always love reading a Carol Topp book! She writes in an easy to understand format with links & resources to back up what she’s saying. The tax infomation is up to date in this Kindle Book which I was happy about. I love the examples of other teen businesses. Over all, if you want to start a small teenage business, this is the book for you!

christie –

Five Stars

perfect for my son’s business class at co-op

moneymatters –

Great tool for adults, too!

This is a great tool for not only teens, but adults too! Jam packed with helpful, easy to read information!

Coach Vissers –

Very helpful

After becoming self employed later on in our adulthood this book was very helpful primer for us too even though we re no longer teens.

T. H. –

Liked!

This was a very good transaction. We liked the book. And would order again from this seller.Thank you for your honesty.

Tara –

Clear and concise…

One of the best gifts a parent can give their child is information about handling money. Ready to take it up a notch? Give them the tools to run their own micro business. Check out the Micro Business for Teens series:- Starting a Micro Business- Running a Micro Business- Micro Business for Teens Workbook- Money and Taxes in a Micro BusinessCarol Topp, author and CPA, packs her years of experience into a full curriculum that will equip your student with all the information they need. Packed full of real examples of successful teen businesses alongside doable, practical advice, each book is a resource your child will turn to time and time again.From figuring out where to start, developing a marketing plan, record keeping, and time management, each book walks students step by step in simple, clear teachings. The ideal instruction manual for a young entrepreneur in the making.

KitriMoon –

A Tremendous Resource

This is a tremendous resource for teens who are on the verge of or who have made money from a micro business and need to understand taxes. Detailed, up to date and interesting, the author explains in great and simple details the things a student would need to know in order to follow the rules and to understand what is required when the time comes to pay their taxes. This book will be invaluable for both parents and students alike; parents are certainly going to learn some new things along with their child. Once having read this book, the worry of when and why and how to deal with taxes will be much easier to deal with, I highly recommend it, along with other books by the same author.

springvalley –

Absolutely essential!

This is the best book I’ve seen for explaining the ins and outs of teens and taxes. There are jobs teens can have under age 18, plus different kinds of income, that can be tax-free. The author goes into detail about all these different cases. She gives examples of how to figure taxes on various incomes. If your child works in a family business, or gets money from relatives, or works part-time, you will find answers here. If your child wants to start her own business, things can turn into a spaghetti factory very quickly if she is not aware of what taxes she will owe. My son used the author’s advice when working for his dad and with his etsy store. It gave us the peace of mind that we needed.